Components of Islamic Money Market

A Mudharabah Interbank Investment MII Back to Top. Three components of the IIMM are Islamic Interbank Market IIM Islamic Interbank Cheque Clearing System IICCS and Islamic Money Market Instruments.

What Is Money Market Definition Functions Instruments And Importance The Investors Book

The Islamic money market comprised 3 components i Trading of Islamic Financial The islamic money market comprised 3 components i School Universiti Teknologi Mara.

. Monetary Operations in Islamic Money Markets. We will also discuss the role of money markets and the need for Shariah-compliant sources of funds. Its three main components are the interbank deposit facility the trading platform for Islamic money market instruments and the Islamic check clearing system.

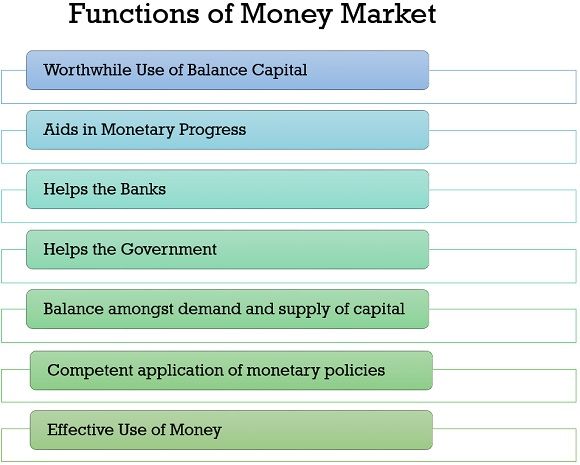

IIMM can perform all the functions and provides the facilities that a conventional money market can. Islamic Conventional Money market instruments Paper Type. Types of Instruments in Islamic Interbank Money Market.

Compare Rates Open Online Today. The money market capital market derivative market commodity market and foreign exchange market together constitute the countrys financial market. MII refers to a mechanism whereby a deficit Islamic banking institution investee bank can obtain investment from a surplus Islamic banking.

Money Market Components in Islamic Finance. Bank Negara Monetary Notes-i BNMN-i Sukuk Bank Negara Malaysia Ijarah SBNMI Malaysian Islamic Treasury bills MITB Islamic Negotiable Instruments of Deposit INID Mudharabah based Negotiable Islamic Debt Certificate NIDC sales of banks asset and repurchase Collaterised. Through the Qard acceptance the Bank manages liquidity in the context of a surplus liquidity environment by inviting Islamic banking institutions to place their surplus funds with the Bank.

Find the Best APY. The chapter points out that the money market can be described as the financial market for transactions in wholesale short-term funds. This paper advocates a holistic Shariah adaptation of the modus operandi operational model of the Islamic interbank money market.

Credit Facilities Offered by Central Banks. The money market is an essential and integral component of the financial system. Many of the conventional instruments have been replicated into Shariah -compliant ones.

Find a Dedicated Financial Advisor Now. Though structurally the same the IIMM has had its own set of issues. Can be described as the wholesale market for short term funds overnight to 12 months.

Need to discuss further. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Up to 5 cash back 5 Calculate the price or proceeds of Islamic money market instruments.

What is the structure of the Islamic capital markets by financial instruments. Ad Sharia Compliant Home Business Finance thru Licensed Providers. Fundamentally the Islamic money market comprises the interbank market and m o n e y m a r k e t.

List the components of the Islamic capital markets by participants. Islamic Inter-bank Cheque Clearing System Government Investment Certificate GIC Cagamas Mudharabah Bonds Islamic Accepted Bills IAB Islamic Treasury Bills Repurchase Agreements REPO. Published on March 2017 Categories.

Islamic Interbank Market IIM. Do Your Investments Align with Your Goals. What are the components just list of the Islamic money markets by market instruments.

We Utilize Quantitative And Qualitative Tools To Manage Money Market Strategies. List the Islamic capital market instruments by the types of markets. Ad Bringing Scale Stability Broad Capabilities In Pursuit Of Consistently Strong Returns.

You will learn about the different instruments and components of an Islamic Money Market. The transactions in the primary and secondary money markets take place over-the. The main participants in the money markets are banks non-bank financial institutions such as takaful and insurance companies business corporations government treasuries and the Central Bank.

Monetary Operations and Public Debt Management. T h e m a j o r m a r k e t p l a y e r s a. The Bank influences Islamic interbank market liquidity through an array of Shariah-compliant instruments the main instrument being the Qard acceptance loan.

The IIMM covers the Mudharabah Interbank Investment and Interbank trading of Islamic financial instruments. The Islamic financial market Islamic Capital Market Islamic banking Financial Products Takaful Investment Products Equity Sukuk Shariaa-compliant derivatives Islamic Fund Management Islamic REITs Islamic Structured Products Islamic stock broking ijara istisnaa musharaka Shariaa deposit investment products Money market products. It is financial market for transactions of financial assets between buyers sellers between borrowers and lenders.

Ad Open a New Money Market Account Today Start Maximizing Your Interest. Money Market Components in Islamic Finance. Grow Your Savings with The Most Competitive Rates.

Islamic Money Market Instruments There are some of the Islamic Money Market Instruments as below. Al-Mudaraba Interbank Investment. Islamic Money Market Essential and integral component of the financial system.

Topic 6 Financial Markets In The Islamic Financial System Ppt Download

Structure Of The Components Of The Islamic Interbank Money Market Iimm Download Scientific Diagram

Money Market Components In Islamic Finance Pdf Money Market Bonds Finance

0 Response to "Components of Islamic Money Market"

Post a Comment